“Get ready for Brexit by helping – not hitting – the self-employed in the Budget”

Pre-Budget hints that Chancellor Philip Hammond is eyeing tax raids on freelancers in the impending Budget, together with other tax raising measures to end “austerity” in some of the public sector, is the “wrong medicine at the wrong time – and would be an epic disaster for the tech sector and economy if they are implemented” warns Lee Murphy, the CEO and founder of Pandle, the cloud accountancy software with nearly 20,000 freelance and microbusiness users.

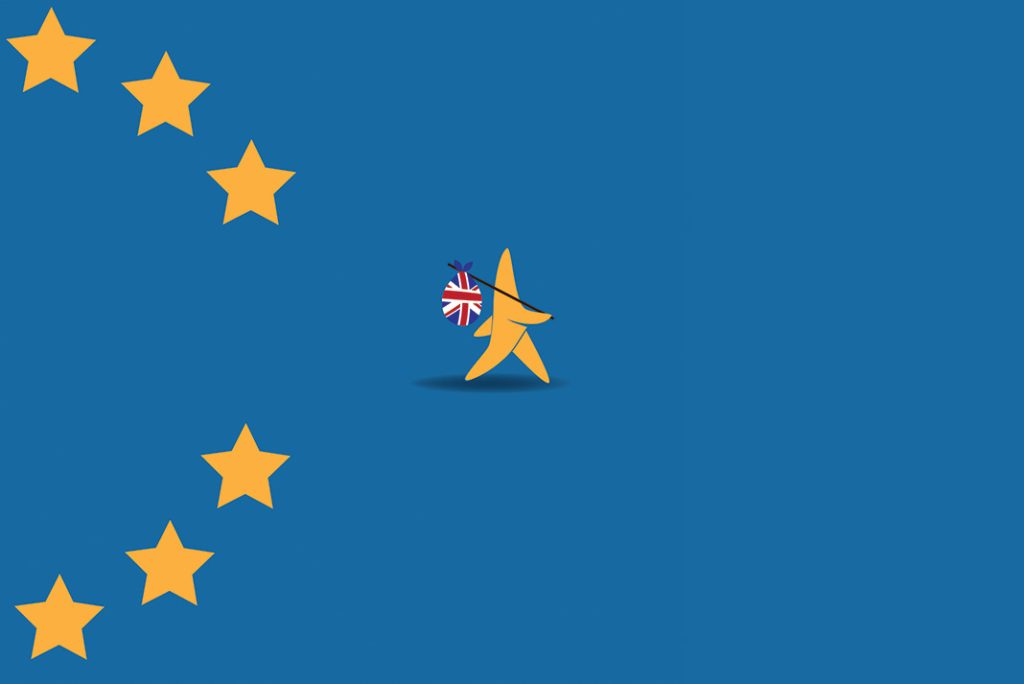

Lee Murphy, an accountant and tech entrepreneur, said: “Brexit is bearing down on us, whether it is next March or drifts off to later in the year. The Chancellor should make sure the most flexible and successful sections of the economy are able to fire on all cylinders to offset any temporary shock to the economy of leaving.

“The massive growth in people freelancing, particularly professionally and technically skilled mature workers and working mothers, is at the heart of Britain’s success of creating more jobs and low unemployment. It is no coincidence that London and the South East have been the UK’s economic powerhouse and has, disproportionately, far more freelancers and self-employed than elsewhere.

“Short-term tax raids on Britain’s 2 million freelancers and 3.3 million other microbusinesses will hurt the economy badly by damaging this dynamic sector, while costing employers dearly in additional costs and skill shortages.”

Lee Murphy added: “The Chancellor should be concentrating on getting Britain ready for Brexit by helping – not hitting – the self-employed in the Budget. Raising taxes and red-tape at the behest of the taxman to account for higher pay in the public sector is the wrong medicine at the wrong time.

“This should be a budget to help the economy be as strong as flexible for difficult times ahead, and a big part of this is protecting and nurturing our flexible army of talented freelancers and microbusinesses”.

Danger areas the Chancellor should back down from:

1 – Likely tax raid on freelancers

Last year the government compelled all public sector bodies to stop using freelancers unless they are provided by umbrella companies or operate a company inside HMRC’s “IR35” regime, which aims to ensure people are genuine freelancers and not “disguised employees” being paid this way to avoid National Insurance payments.

It has been a disaster for many public sector organisations, with large numbers of skilled tech freelancers transferring to the private sector while many others have become full-time employees (increasing the long-term costs for the taxpayer). HMRC recently published a consultation strongly arguing for it to be applied to the private sector too.

Lee Murphy of Pandle said: “Freelancers and the self-employed do not receive substantial tax benefits, particularly when you consider they will not be benefiting from employment rights such as sick pay, holiday pay, redundancy pay nor an employer’s pension contributions. Hitting people with so few benefits to end “austerity” in the public sector, where there are entrenched benefits, job security and gold-plated pensions will be hugely damaging.

“The taxman is paranoid that lots of freelancers are really “disguised employees” who work full-time for one employer on an indefinite basis. There is a bit of that but tackling it by hitting two million innocent people with massive cost and bureaucracy, not to mention additional costs being passed onto the organisations that use them, will damage this essential part of Britain’s economic success at the worst possible time.

“What’s more, the abolition of Class 2 National Insurance not going ahead is certainly a mistake – not only for the relief on sole traders but also the simplification of the National Insurance system. This would have been a great move to include all NI for sole traders under Class 4 NI and simplify the system.”

How should the Chancellor keep the economy flexible to ensure the economy continues to thrive regardless of any Brexit shock?

More financial aid to small businesses in the form of start-up loans and business growth could support the UK economy post-Brexit.

Lee argues: “Whilst some initiatives are already in place, I think the real issue lies in banks not favouring these types of loans, as opposed to loans secured on assets like property.

“All this does is concentrate capital on inflating asset classes rather than growing the productive economy. If we had a lot more money pumped into small businesses, then the whole economy would be much better off as a result.”